Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- Annual Marriott Bonvoy Credit

- Airport Lounge Access

- High Annual Fee

- Limited Elite Status

Rates & Fees / Terms Apply

Rewards Plan

Welcome Bonus

Our Rating

PROS

- Annual Marriott Bonvoy Credit

- Airport Lounge Access

CONS

- High Annual Fee

- Limited Elite Status

APR

20.99% - 29.99% Variable

Annual Fee

$650

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Marriott Bonvoy Brilliant® American Express® Card is one of five co-branded cards offered by Marriott – and the most luxurious one between them.

The card's standout benefits include Marriott Platinum Elite status, an annual free-night award, up to $300 in restaurant credits, a $100 property credit for certain stays, and Priority Pass Lounge access. Additionally, it provides travel protections, an application fee credit for Global Entry or TSA PreCheck, and shopping protections.

Earning structure involves 6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases. While the card offers valuable perks, its non-Marriott earning rates are relatively low, suggesting users might want to pair it with other cards for better rewards.

Redeeming points allows for free stays at over 7,500 properties worldwide, with options for high-end luxury accommodations. Points can also be transferred to more than 35 airline partners, although this may not always offer the best value.

While the card offers valuable perks, its non-Marriott earning rates are relatively low, suggesting users might want to pair it with other cards for better rewards. Also, the card's high annual fee may be a deterrent for some.

What Are The Top Reasons Not To Get The Marriott Bonvoy Brilliant?

If you’re not a keen Marriott Bonvoy visitor, you are unlikely to get the best rewards with this card. If you are not brand loyal to Marriott Bonvoy, you would be better suited to a more general travel rewards card.

Can I Add An Authorized User?

Yes. You should be able to add an authorized user to your account via the online dashboard or alternatively, you can call the customer service team who can guide you through the process.

What’s The Main Uniqueness Of Marriott Bonvoy Brilliant?

The main unique feature of this card is that although it is heavily weighted towards Marriott Bonvoy, it also offers some nice perks, such as purchase protections, car rental coverage and lounge access.

How Long Does It Take To Get Approved?

If you complete the online application, you should expect to receive an approval decision in as little as 30 seconds. However, there may be occasions when American Express needs a little additional time to make an approval decision.

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

In this Review

Pros & Cons

Let’s take a closer look at the pros and cons of the Marriot Bonvoy Brilliant Card:

Pros | Cons |

|---|---|

Up to $300 Restaurant Credits | Annual Fee |

Free Night Award | Limited Non-Marriott Earning Rates |

$100 Property Credit | Points Transfer May Not Be Ideal |

50% More Points on Eligible Purchases | $100 Property Credits Limitations |

Platinum Elite Status | |

Global Entry/TSA PreCheck Credit

| |

No Foreign Transaction Fees |

- Up to $300 Restaurant Credits

Every cardmember year, you’ll get up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide.

- Free Night Award

On your card anniversary, you’ll receive one free night award that you can redeem at participating Marriott Bonvoy hotels with a redemption level at 85,000 points or below.

- $100 Property Credit

If you book and pay for a stay at The Ritz Carlton or St Regis for two or more nights using your Brilliant card, using the $100 Property Credit Luxury rate, you’ll get a credit of up to $100 towards qualifying property purchases. The credit will appear on your bill at checkout rather than being applied as a statement credit.

- 50% More Points on Eligible Purchases

50% more points on eligible purchases at participating hotels for each U.S. dollar or the currency equivalent that is incurred and paid for by the member

- Airport Lounge Access

This card provides a complimentary Priority Pass Select membership. After you enroll, you can enjoy unlimited lounge visits for you and up to two guests at over 1,300 Priority Pass lounges.

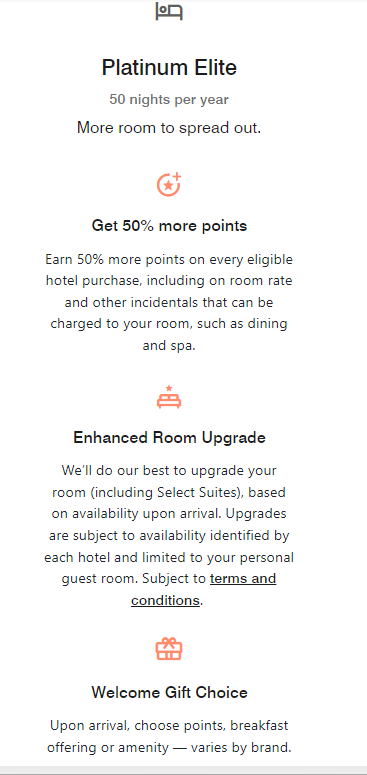

- Platinum Elite Status

Cardholders receive complimentary Marriott Platinum Elite status, providing access to perks like room upgrades, complimentary breakfast, and lounge access.

- Global Entry/TSA PreCheck Credit

If you pay your Global Entry or TSA PreCheck application fees with your card, you’ll get up to $100 in statement credit as reimbursement.

- No Foreign Transaction Fees

You can use your Marriott Bonvoy Brillian American Express even if you’re traveling abroad, as you’ll not incur any foreign transaction fees on non U.S dollar charges.

- Annual Fee

While there are some nice perks associated with this card, they do come at the cost of a high annual fee.

The card has a $650 fee per year, which can be offset if you frequently visit Marriott properties. However, if you’re not a regular Marriott visitor, you may struggle to recoup the annual fee with the card rewards.

- Limited Non-Marriott Earning Rates

The card's earning rates on non-Marriott purchases are relatively low, suggesting users may need to complement it with other cards for optimal rewards.

- Points Transfer May Not Be Ideal

While the card allows points transfer to over 35 airline partners, the data suggests this may not always provide the best value compared to other redemption options.

- $100 Property Credits Limitations

The $100 property credits are only applicable for stays of two nights or longer booked directly with Marriott, restricting flexibility for those using online travel agencies.

Additional Benefits

The Brilliant card comes with additional benefits and protections, including:

- Earned Choice Award: After spending $60,000 on eligible purchases in a calendar year, you can choose an Earned Choice Award benefit such as getting Suite Night Awards™ (five) to redeem for upgrades to select premium rooms and suites, gift Marriott Bonvoy® Silver Elite Status to a family member or friend and more.

- 25 Elite Night Credits: Cardholders receive 25 elite qualifying night credits annually, helping fast-track to higher elite status within the Marriott Bonvoy program.

- Premium Internet Access: Receive complimentary in-room premium Internet access at participating Marriott Bonvoy properties.

- American Express Experiences: Gain exclusive access to ticket presales and Card Member-only events, including entertainment options like Broadway shows, concerts, family events, and more. Visit the American Express website for more information.

- Car Rental Loss and Damage Insurance: By using your Eligible Card to reserve and pay for a rental car while declining the rental counter's collision damage waiver, you gain protection against damage or theft in specific regions, with certain exclusions and limitations.

- Baggage Insurance Plan: When you use your Eligible Card to purchase a common carrier vehicle ticket, you are covered for lost, damaged, or stolen baggage.

- Trip Cancellation and Interruption Insurance: Booking a round-trip with your Marriott Bonvoy Brilliant American Express Card offers assistance in the event of trip cancellation or interruption, subject to specified terms and conditions.

- Trip Delay Insurance: If your trip is delayed by more than 6 hours due to a covered reason and the round-trip was paid for with your Eligible Card, you are eligible for coverage.

- Purchase Protection: Eligible purchases made with your card receive protection for up to 90 days from the purchase date, covering theft, accidental damage, or loss.

- Extended Warranty: When you use your Eligible Card for eligible purchases, you receive an additional year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This built-in benefit reimburses repair or replacement costs for cell phones damaged or stolen when purchased with your Eligible Card.

Point Rewards Analysis: What's The Annual Value?

While the exact calculation depends on your personal spending habit, we've analyzed the expected annual rewards value based on pre-determined spending in different categories:

| |

|---|---|

Spend Per Category | Marriott Bonvoy Brilliant |

$10,000 – U.S Supermarkets | 20,000 points |

$5,000 – Restaurants | 15,000 points |

$6,000 – Hotels | 36,000 points |

$8,000 – Airline

| 24,000 points |

$4,000 – Gas | 8,000 points |

Total Points | 103,000 points |

Estimated Redemption Value | 1 point ~ 0.8 cent |

Estimated Annual Value | $824 |

How to Maximize the Bonvoy Brilliant Benefits?

Since this is a Marriott Bonvoy credit card, the best ways to maximize the benefits of the Brilliant American Express all relate to this hotel chain. You’ll maximize your card benefits with frequent stays that will allow you to access statement credits and further rewards.

However, there are some additional ways that you can maximize your Marriott Bonvoy Brilliant benefits.

- Sign Up for Global Entry or TSA PreCheck: Since American Express will reimburse you for the application fee if you pay with your Marriott Bonvoy Brilliant, there is no reason not to harness the benefits of these traveler programs. While there is some admin involved in signing up, you can enjoy a reimbursement every four years or 4.5 years, depending on the program, of up to $100.

- Pay For Car Rental With Your Card: Like many Amex travel cards, the Marriott Bonvoy Brilliant offers rental car loss and damage coverage if you book and pay for your rental with your card. This is additional coverage, but you won’t need to pay for the optional coverage at the rental counter.

- Don’t Just Pay for Travel Purchases: Although the card is Marriott Bonvoy centered, you can also enjoy purchase protections on eligible items. This means that if you buy electronics and other non travel items, you could qualify for extended warranties and damage protection, if you pay using your card.

Marriott Bonvoy Brilliant Redemption Options

The Marriott Bonvoy Brilliant® American Express® Card offers various redemption options for its cardholders, allowing them to maximize the value of their Marriott Bonvoy points. Here are some key redemption options:

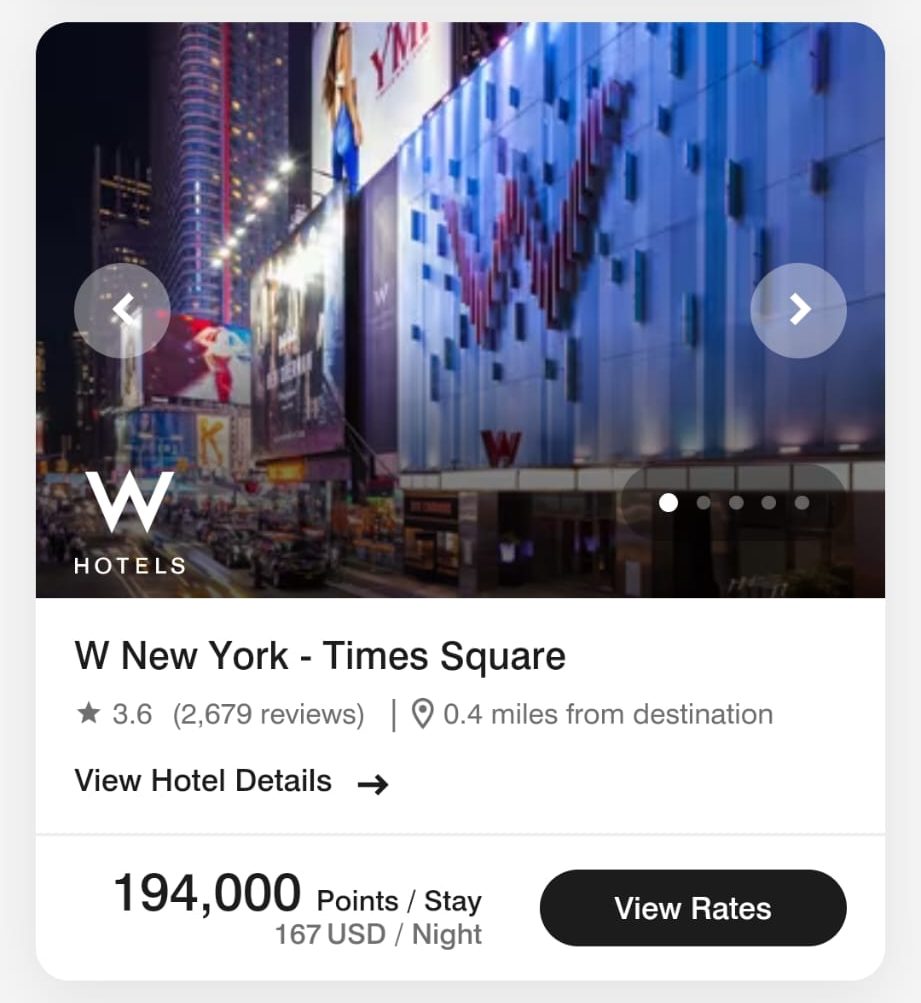

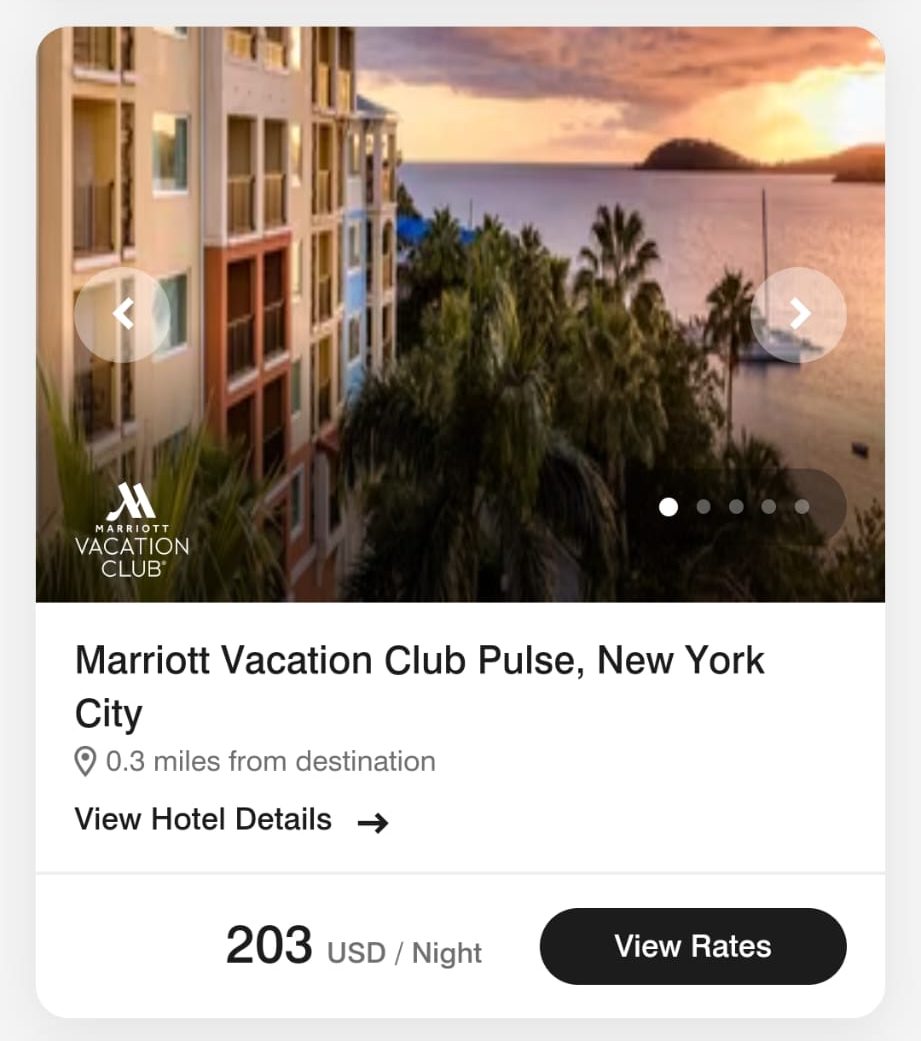

Free Hotel Stays: Cardholders can use their Marriott Bonvoy points to book free nights at over 7,500 Marriott properties worldwide. Redemption values may vary depending on the hotel category and location.

- Transfer to Airline Partners: Points can be transferred to more than 35 airline partners. While this option may not always provide the highest value per point, it can be useful for topping off airline loyalty accounts or securing specific flight redemptions.

Travel Packages: Marriott offers travel packages where cardholders can redeem points for a combination of hotel stays and airline miles. This can be a strategic way to maximize value, especially for those planning both hotel stays and air travel.

Room Upgrades: Cardholders may use points to secure room upgrades at Marriott properties, enjoying enhanced accommodations and amenities during their stays.

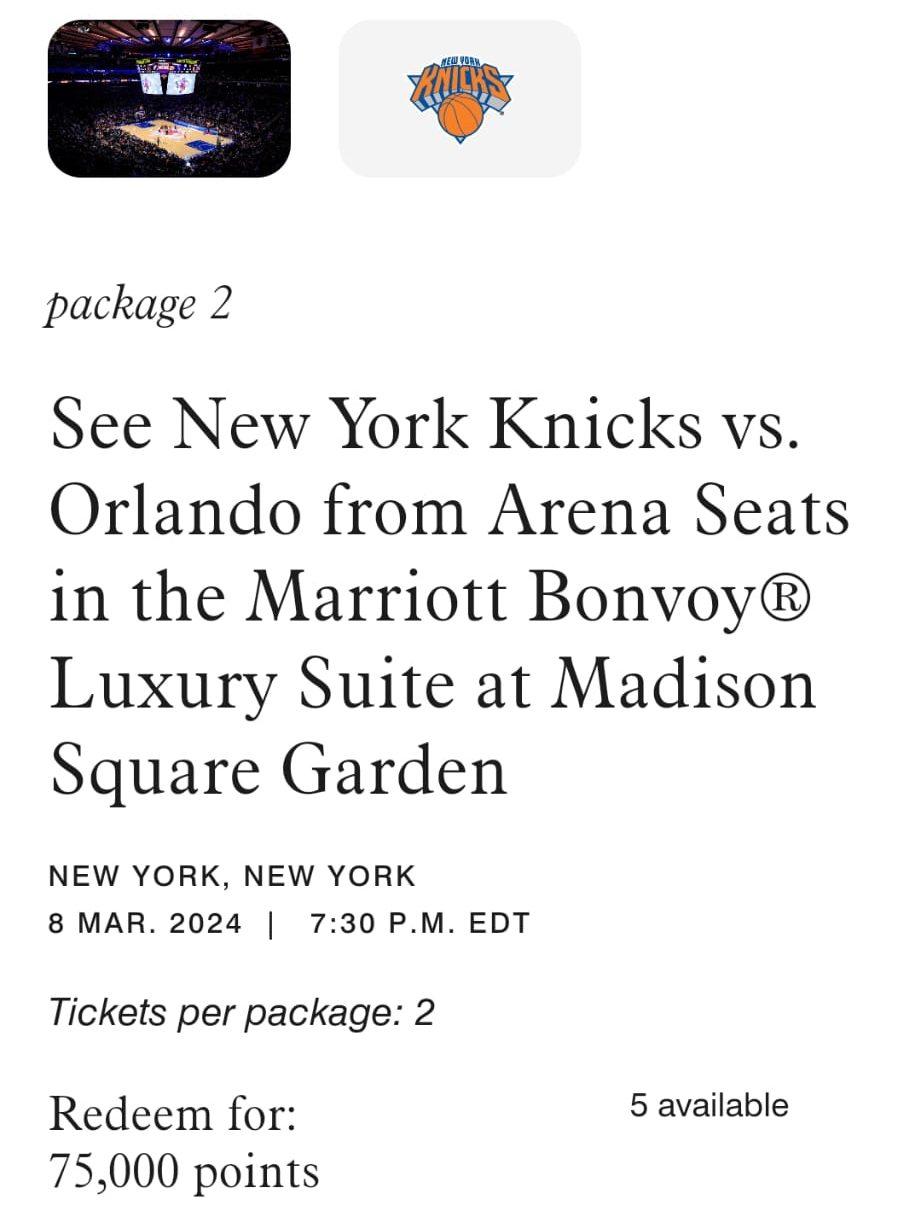

Experiences: Marriott's Moments program allows cardholders to use points for exclusive experiences, such as concerts, sporting events, and culinary adventures, providing a unique way to redeem points for memorable activities.

- Shopping and Merchandise: The Marriott Bonvoy program includes an online merchandise catalog where cardholders can use their points to purchase a variety of products, from electronics to fashion items.

Does It Have a Good Customer Service?

American Express has strong customer service, with 24/7 availability online or via the phone helpline. If you do have any queries or concerns, you can easily access a member of the team. American Express also has an impressive app for both iOS and Android devices.

The Amex app is highly rated on both the Apple Store and Google Play, allowing you to easily manage all aspects of your account while you’re on the go. You can also access your account details online.

The American Express website has a clean design with intuitive layout providing a great user experience. You can explore all the available products, but there is also a comprehensive help section with how to videos and support materials, along with the possible avenues to access the customer service team.

How To Apply For Amex Bonvoy Brilliant?

American Express has a comprehensive website that allows you to explore all the card options online. You can also apply via the website rather than needing to deal with a lengthy customer service call.

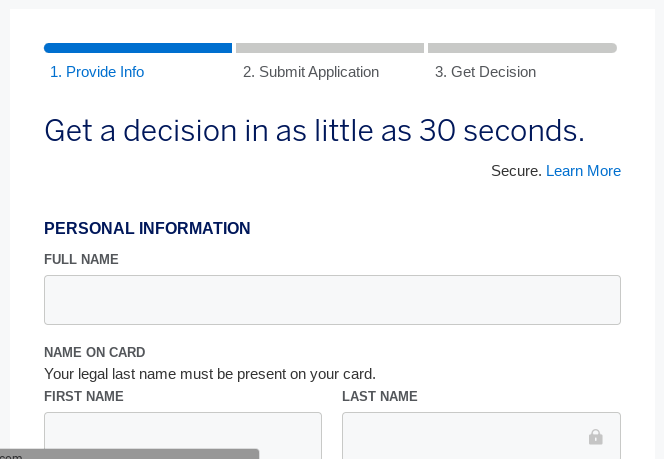

To start the application process, simply click on the Marriott Bonvoy Brilliant product page. You’ll find this card under the Travel Rewards tab on the main personal cards menu.

You will see an option to view further details, or go straight to “Apply Now.” This will take you to start the application.

Be sure to note at the top right hand corner of the page, the options to select if you’re already a card member or if you’re responding to a mail offer.

The application is quite standard and straightforward and you can complete it in a matter of minutes. You’ll need to provide your full name, email address, date of birth, address and Social Security Number.

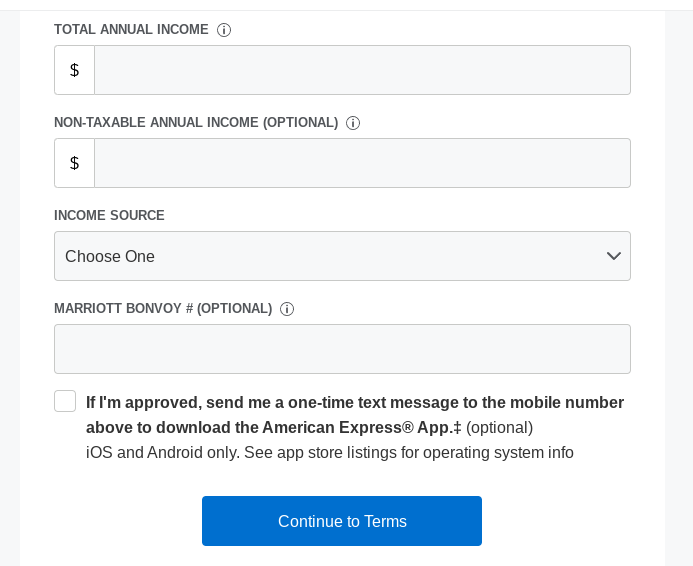

- 3.

However, there is also an income section to the application, so be prepared to provide your financial income figures and sources.

- 4.

Once you complete the application, you have the option to proceed to the terms or save your application to complete later.

If you proceed, you’ll need to review the terms and conditions and then submit. You should receive an approval decision in approximately 30 seconds.

Compare The Alternatives

The Amex bonvoy brilliant is good chocie if you are looking for an hotel card. However, there are similar cards with great benefits you may want to take a look before applying:

|

|

| |

|---|---|---|---|

World of Hyatt Credit Card | Marriott Bonvoy Boundless® Credit Card | Hilton Honors American Express Card | |

Annual Fee | $95 | $95 | $0 |

Rewards |

1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

|

1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

|

3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

|

Welcome bonus |

Up to 60,000 Bonus Points

30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening.*Opens offer details overlay Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

|

3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

|

70,000 points

70,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

|

Foreign Transaction Fee | $0 | $0. | $0. See Rates and Fees. |

Purchase APR | 21.49%–28.49% variable | 21.49%–28.49% variable | 20.99%-29.99% Variable

|

FAQ

American Express does not specify specific income requirements to qualify for the card. Amex will review your entire credit history along with your income to evaluate your application. You will need a good to excellent credit score, so you may be approved, if you have a high score but a lower income.

While the main application form does not provide an option to get pre approved, there is a separate log in for people responding to a mailer. This should allow you to confirm pre approval, to avoid triggering a hard credit pull.

There are no official credit limit minimums for this card. However, some customers have reported being approved for a far lower credit limit compared to other card issuers.

Yes, the American Express website is very intuitive and well laid out. You can access online support 24/7 and manage your account via the highly rated app, which is available for both iOS and Android users.

Excellent. You can access the customer service team online or by phone 24/7. There is also a comprehensive help section on the website for any general queries or questions.

Compare Marriott Bonvoy Brilliant Card

While there is no big difference when it comes to points rewards, the Brilliant offers lounge access, credit statements, and Platinum status.

The Brilliant is more expensive than the Bevy card but offers more premium perks such as dining credit, lounge access, and TSA PreCheck.

There is no real difference in annual cashback, despite the difference in annual fees. However, the Brilliant card offers premium hotel perks.

Marriott Bonvoy Bountiful vs Brilliant: : Which Card Is Best?

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

Amex Platinum Card vs. Marriott Bonvoy Brilliant Card: Which Luxury Travel Card Is Best?

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: Which Luxury Travel Card Is Best?

Surprisingly, while having a lower annual fee, the Hilton Amex Aspire's estimated cashback value is higher than the Marriot Brilliant's card.

Marriott Bonvoy Brilliant vs. Hilton Amex Aspire: : Which Luxury Hotel Card Is Best?

Top Offers

Top Offers